The telling figure below from an NBER paper (wp) by Allen, Dechov, Pope and Wu has been shared by several people this summer. From data on almost 10 million marathon finishing times, they show how people use their prospective finishing time as motivation to provide more effort and bunch at every 30 min. interval.

Tag Archives: economics

“[…] by pushing his jam always forward into the future, [the “purposive” man] strives to secure for his act of boiling it an immortality”

John M. Keynes thus criticized an excessive preoccupation with the future in his essay Economic possibilities for our grandchildren (1930). I was a bit puzzled by this, and the full quote does not really help:

The “purposive” man is always trying to secure a spurious and delusive immortality for his acts by pushing his interest in them forward into time. He does not love his cat, but his cat’s kittens; nor, in truth, the kittens, but only the kittens’ kittens, and so on forward forever to the end of cat-dom. For him jam is not jam unless it is a case of jam to-morrow and never jam to-day. Thus by pushing his jam always forward into the future, he strives to secure for his act of boiling it an immortality.

Helpfully, there is a Wikipedia page on the “jam tomorrow“. It turns out that the jam reference comes from Lewis Carroll’s Through the Looking Glass (1871), in which the White Queen offers Alice to work in exchange for jam that she (Alice) will always receive tomorrow, i.e. never. Back to Keynes: Such forward-looking behavior is helping to solve the economic problem, but as soon as that is done (it will take at least 100 years), we can stop pushing the jam into the future.

(And presumably start eating it, though Alice says she does not care for jam, but perhaps that is another story.)

Trillion dollar bills on the sidewalk

In case you did not notice, Michael Clemence found trillion dollar bills on the sidewalk a few years back. Happy Open borders day!

An experiment on how to improve journal referee speed

Chetty, Saez and Sandor have experimented on the referees of the Journal of Public Economics. They find that somewhat unsurprisingly that shorter deadlines, cash incentives and social incentives make referees faster. Further, cash does not crowd out intrinsic motivation, report quality is unaffected, and spillovers on other referee activites are small or nonexistent. They do note that “[O]f course, referees must forego or postpone some activity to prioritize submitting referee reports. The social welfare impacts of our treatments depend on what activities get displaced.” To the extent that it is just procrastination that is crowded out, the conclusions could be even more positive.

H/t: @JFiva

The persistent effect of affirmative action

Conrad Miller from MIT finds in his job market paper that US affirmative action regulation introduced from 1979 onwards had substantial effect on the black share of employees, also after deregulation. The exogenous variation comes from “changes in employers’ status as a federal contractor” and the fact that it was only federal contractors who were subject to these regulations. To get at the full dynamic effect of the regulation, Miller does not stop at comparing employers when they switch contractor status, but exploits also variation in when the firms are contractors for the first or the last time. In this way he can estimate whether there is a (persistent) causal effect also after a firm has lost his status as a federal contractor (has become “deregulated”).

The event study results are striking:

- Figure 2 Event studies, from Miller 2014 The persistent effect of temporary affirmative action

The effect is quite small – becoming a contractor on average increases an establishment’s black share of around 0.15 percentage points per year – but the key point is that it persists, even when the firm is no longer is a contractor. There is much more in the paper, including a proposed explanation in terms of employers being induced to improve their screening procedures for potential employees.

The effect of football on work motivation and well-being

“Is soccer good for you? The motivational impact of big sporting events on the unemployed” is an article in Economic Letters (ungated) by Philipp Doerrenberg and Sebastian Siegloch at IZA that I believe a lot of people wished they had written. The authors analyze the effect of the Euro Cup and the World Cup on the unemployed in Germany:

We examine the effect of salient international soccer tournaments on the motivation of unemployed individuals to search for employment using the German Socio Economic Panel 1984–2010. Exploiting the random scheduling of survey interviews […] We show that respondents who are interviewed after a tournament have an increased motivation to work but, at the same time, request higher reservation wages. Furthermore, the sporting events increase the perceived health status as well as worries about the general economic situation. We also find effects on the subjective well-being of men.

The unemployed are made more motivated to work and more worried, and to perceive themselves as being healthier, but men’s well-being is decreased. Ht: Kevin Lewis.

Ragnar Frisch on economic planning

Ragnar Frisch in the early 1960’s had high hopes for future Soviet economic development:

The blinkers will fall once and for all at the end of the 1960s (perhaps before). At this time the Soviets will have surpassed the US in industrial production. But then it will be too late for the West to see the truth. (Frisch 1961a)

That is from an article by Sæther and Eriksen in the new Econ Journal Watch. The paper contains much more than this angle.

It must be said that it was quite common for economists at the time to believe that the Soviet Union had a sustainable system. For instance Paul Samuelson, who repeatedly pushed his predictions for when the American GNP would be overtaken by the Soviet GNP further into the future. If anyone knows about any modern Norwegian debate about this, I would be interested to learn about it.

H/t: MR, Arnold Kling.

Welfare helps the children of the poor and unemployed

That may sound obvious, but debates about welfare too often focus on the worthiness of the recipients, i.e. the adults.

Matt Yglesias summarises a recent academic study of a cash transfer scheme that took place during the Great Depression in the US. Kids of mothers who received cash transfers went on to earn more, live longer, have better health and obtain more schooling. These were really long-term – lifetime – outcomes.

“Oslo is the cradle of rigorous causal inference”

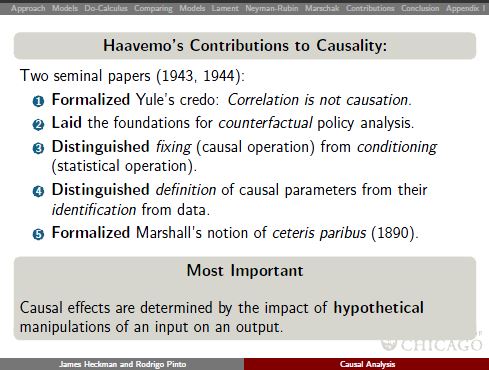

Those are the words of James Heckman, from a lecture (slides, paper) at the University of Oslo last week. In particular, it is Trygve Haavelmo’s 1943 paper The statistical implications of a system of simultaneous equations (pdf) that gets the honor of being “the first rigorous treatment of causality”. A summary:

According to Heckman, Haavelmo built on Marshall’s general idea of ceteris paribus to define fixing (“an abstract operation that assigns independent variation to the variable being fixed (p. 8)”), that is to be distinguished from classical statistical conditioning (“a statistical operation that accounts for the dependence structure in the data (p. 8)”). This fixing occur hypothetically, thus causality becomes defined in terms of thought experiments, along the earlier thoughts of Ragnar Frisch. In Heckman’s words: “Causal effects are not empirical statements or descriptions of actual worlds, but descriptions of hypothetical worlds obtained by varying – hypothetically – the inputs determining outcomes. (pp. 2-3)”.

Much of the lecture and paper is a polemic against Pearl’s do-calculus. Those interested in that debate can read Heckman and Pinto’s paper and Pearl’s comments on it, watch a conference discussion they had last year, or read stuff that more able people than me have blogged about before. Not debatable, though, is that Heckman knows to please his hosts.

Breakfast with Bill Gates

Breakfast meeting on “Commercial Investments as a tool for Development,” organized by the think-tank Civita.

Bill Gates, in Norway to try to secure continued funding for his foundation’s aid programs, started out by giving kudos to Norway’s wealth management strategy and aid generosity. He argued that it would be feasible for Norway to invest a small part of the oil money with a “dual goal” objective – investing in countries that are short on capital, and where the investments could both provide a financial return and help financing needed basic infrastructure (electricity, roads, agriculture). He ducked a couple of hard issues. On a question from Paul-Christian Rieber on how to deal with oppressive regimes, he said that it was up to the national governments themselves to set their own rules and that he believed in engaging with most countries. I wished he had been more specific about how to engage. On a question from journalist Maria Berg Reinertsen on challenges related to taxation, Gates only said that planning was fair. A more helpful response was given by State Secretary Jon Gunnar Pedersen, who pointed out that tax issues had to be dealt with at an international government level. Pedersen cut a good figure, and also noted that the pension fund already do have investments in the areas that Gates were talking about, such as Sub-Saharan Africa, and that we have Norfund, a government fund whose aim is specifically to invest for development.

While this meeting was about investments, Gates’ next meeting of the day was with the new Prime Minister. Probably hoping that her people would note, he was crystal clear that aid was much more important.